Finance

How Red Lobster was controlled by private equity

Are you frustrated that your favorite Red Lobster location has closed down? The closure of this iconic seafood chain, which served 64 million customers a year across almost 600 locations in the US and Canada, has been attributed to Wall Street wizardry. While some have blamed the company’s woes on promotions like endless shrimp and rising costs, the real culprit may be a financing technique commonly used by private equity firms.

Private equity firms often employ asset-stripping, a practice where they sell off a company’s assets to benefit themselves, ultimately harming the company. In the case of Red Lobster, a sale/leaseback involving the sale of premium real estate under 500 stores generated $1.5 billion, but the money did not go back to the chain. Instead, it was used to finance Golden Gate Capital’s purchase of Red Lobster, increasing the chain’s rent costs significantly.

As a result of the sale, Red Lobster was unable to benefit from any potential upside in the commercial real estate market and faced above-market rent prices. This, combined with the increased debt burden from the private equity buyout, led to financial instability for the chain, ultimately resulting in bankruptcy. Golden Gate Capital exited its investment in Red Lobster in 2020, selling to Thai Union Group and an investor group.

The collapse of companies like Red Lobster has a ripple effect on the broader economy, impacting suppliers, small businesses, and communities. Former employees like Austin Hurst, a grill master at a Red Lobster location, have been left in the lurch following the closures, with limited support from the company. Sen. Edward Markey has raised concerns about the impact of private equity in industries like health care, proposing legislation to increase transparency and oversight.

The negative impact of private equity practices extends beyond individual companies like Red Lobster, affecting workers, suppliers, and communities. As private equity continues to gain influence across various sectors of the economy, it is essential for policymakers and regulators to address the potential harm caused by these financial strategies. By increasing transparency and oversight, we can work towards a more stable and ethical financial system that protects workers and communities from the consequences of asset-stripping and leveraged buyouts.

-

News6 days ago

News6 days agoHouthis in Yemen arrest 11 UN employees and aid workers

-

Auto6 days ago

Auto6 days agoFerrari intends to continue producing V-12 engines until they are prohibited by law.

-

News7 days ago

News7 days agoPhoto: 12-year-old machete murderer seen with 16-inch knife in his pants before fatal stabbing

-

News6 days ago

News6 days agoResurfaced Interview from 2023 Shows Biden Saying His Son ‘Did Nothing Wrong’ Despite Guilty Verdict

-

Videos7 days ago

Videos7 days agoTop 10 WWE NXT moments: WWE Top 10, May 28, 2024

-

News5 days ago

News5 days agoDid Luke D’Wit, the killer of fentanyl, also murder his father and grandfather? Police investigate their deaths after the 34-year-old was convicted of poisoning a married couple in their £1m home.

-

News7 days ago

News7 days agoLive Updates from Apple WWDC 2024: Expected Announcements Such as iOS 18, AI Features and More

-

News7 days ago

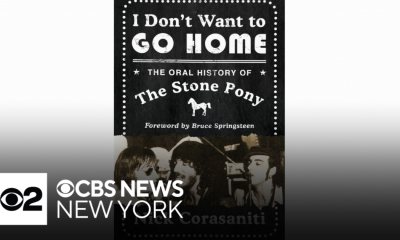

News7 days agoHistory of the Stone Pony Music Venue Explored in New Book