Investing

This is where BlackRock’s bond expert Rick Rieder sees opportunities right now

In the current fixed income market, BlackRock’s Rick Rieder believes that investors have the opportunity to secure great yields without having to take on significant risks. Rieder, who serves as the chief investment officer of global fixed income at BlackRock, manages the BlackRock Flexible Income ETF (BINC) which boasts a 30-day SEC yield of 5.95% and a net expense ratio of 0.40%. While higher yields can be obtained by assuming more risk, Rieder warns against this approach, especially considering the inherent volatility of the second half of the year and the upcoming election season. He believes that aiming for an 8% yield could be considered greedy and irresponsible. Rieder anticipates a possible rate cut by the Federal Reserve as early as September, with the expectation that bond yields will decrease as a result.

A key area of interest for Rick Rieder right now is AAA collateralized loan obligations (CLOs), which consist of securitized pools of floating-rate loans to businesses. These assets offer attractive yields of upwards of 6.5% with wide spreads. Rieder also favors single B-rated bonds within the U.S. high-yield market, as he believes they offer income potential with limited default risks. On the other hand, he is cautious about C-rated bonds due to anticipated higher default rates. European credit, especially investment grade and BB-rated high yield, also appeals to him, particularly due to the strength of the U.S. dollar. Additionally, Rieder advocates for investing in quality investment-grade agency mortgages with a limited duration of two to three years while maintaining a strong credit position.

The BlackRock Flexible Income ETF (BINC) reflects Rick Rieder’s investment strategy by emphasizing a multisector approach that balances high quality and high yield. Since its launch in May 2023, the fund has accumulated over $3 billion in assets and has received recognition from Morningstar as one of the best new ETFs of 2023. The fund’s exposure has been adjusted to reflect Rieder’s current preferences, with a reduced interest rate exposure and added high-quality CLOs and European securitized assets. BINC’s allocation includes 31.6% in securitized assets, 11.3% in CLOs, 6.2% in asset-backed securities, 9.6% in commercial mortgage-backed securities, and 4.4% in non-agency MBS. The fund has slightly decreased its exposure to high-yield corporates while maintaining a conservative stance towards emerging markets.

Despite the potential for increased volatility towards the end of the year, Rieder’s strategy in BINC has proven successful, with a total return of 8.35% since inception and a strong performance ranking among its peers. By focusing on higher quality investments, Rieder believes investors can weather market fluctuations and achieve attractive returns. As the fixed income market continues to evolve, Rieder’s cautious approach to risk management and emphasis on high-quality assets positions BINC as a compelling option for investors seeking solid yields without compromising on stability.

-

News6 days ago

News6 days agoHouthis in Yemen arrest 11 UN employees and aid workers

-

Auto6 days ago

Auto6 days agoFerrari intends to continue producing V-12 engines until they are prohibited by law.

-

News7 days ago

News7 days agoPhoto: 12-year-old machete murderer seen with 16-inch knife in his pants before fatal stabbing

-

News6 days ago

News6 days agoResurfaced Interview from 2023 Shows Biden Saying His Son ‘Did Nothing Wrong’ Despite Guilty Verdict

-

Videos7 days ago

Videos7 days agoTop 10 WWE NXT moments: WWE Top 10, May 28, 2024

-

News5 days ago

News5 days agoDid Luke D’Wit, the killer of fentanyl, also murder his father and grandfather? Police investigate their deaths after the 34-year-old was convicted of poisoning a married couple in their £1m home.

-

News7 days ago

News7 days agoLive Updates from Apple WWDC 2024: Expected Announcements Such as iOS 18, AI Features and More

-

News7 days ago

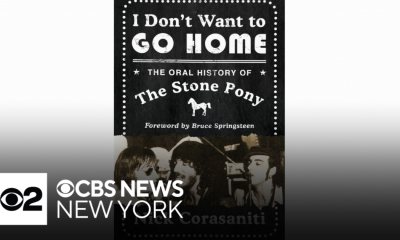

News7 days agoHistory of the Stone Pony Music Venue Explored in New Book