Tech

Shifting AI Podcast: Exploring the Evolution of Artificial Intelligence in 2024 with Microsoft Distinguished Engineer Pablo Castro

Microsoft’s Azure AI platform is at the forefront of innovation in the AI industry, with distinguished engineer Pablo Castro leading the charge. In a recent episode of the Shift AI Podcast, Castro shared insights into three key trends that are shaping the future of generative AI and AI search. These trends include models with longer context lengths, faster AI models, and the increasing sophistication of retrieval systems.

Castro also hinted at upcoming developments from Microsoft, highlighting the focus on removing economic concerns when applying data to artificial intelligence models. This will enable users to achieve greater scale and efficiency with Microsoft’s retrieval systems for generative AI apps. Additionally, Castro outlined specific areas of focus for Microsoft’s Azure AI platform, such as making it easier for customers to create end-to-end AI experiences and scaling AI solutions to secure production environments.

In his role at Microsoft, Castro works at the intersection of language models and knowledge representation, seeking to integrate these technologies to solve business problems effectively. He emphasized the importance of a ‘tight learning loop’ in refining AI solutions based on customer feedback and real-world applications. Looking ahead to 2024, Castro predicts a shift from demos and proofs of concept to full-scale production of AI solutions, presenting new challenges and opportunities for businesses.

Data security is a top priority for Microsoft’s Azure AI platform, with Castro assuring customers that their data is not used for training or improving AI models. He emphasized the importance of maintaining customer privacy and security in all AI applications. Castro also shared his perspective on the future of work, highlighting the capabilities of AI technologies like Copilot to augment human ingenuity and productivity in the workplace.

Overall, Pablo Castro’s insights offer a glimpse into the cutting-edge advancements taking place in the field of AI at Microsoft’s Azure AI platform. By addressing key trends, challenges, and opportunities, Castro and his team are paving the way for the future of AI technology in business operations. Listeners can tune in to the full episode of the Shift AI Podcast to learn more about Microsoft’s endeavors in the AI space and the role of AI in the evolving digital workplace.

-

Politics3 days ago

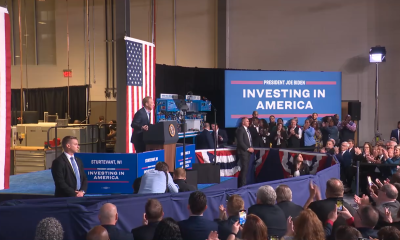

Politics3 days agoLatest news on the 2024 election: Biden fundraising in San Francisco and Seattle regions

-

News3 days ago

News3 days ago£132,000 farmhouse on the brink of 150ft cliff starts demolition as owner evacuated – neighbor vows to stay until his death.

-

Politics3 days ago

Politics3 days agoThe Biden Administration’s decision to publicly confront Israel over Rafah

-

Uncategorized3 days ago

Uncategorized3 days agoThe Washington Post – Breaking news and latest headlines, U.S. news, world news, and video

-

News3 days ago

News3 days ago16-year-old accused of defacing World War I statue in New York City

-

Lifestyle3 days ago

Lifestyle3 days agoSelena Gomez shares adorable photo with Benny Blanco amidst Justin Bieber baby news

-

Wellness3 days ago

Wellness3 days agoExperts Share the 11 Best Sunscreens for Oily Skin in 2024

-

Tech3 days ago

Tech3 days agoHere's an In-Depth Look at How Cadillac Made it to Le Mans In 2023